Credit Score SBP Electric Vehicle Loan in November 2025 – Income Verification & Eligibility

The Credit Score SBP Electric Vehicle Loan 2025 is part of Pakistan’s green financing initiative designed to promote sustainable mobility, energy efficiency, and affordable transport options. The Government of Pakistan, through the State Bank of Pakistan (SBP) and in collaboration with the Ministry of Industries & Production (MoI&P) and the Engineering Development Board (EDB), has launched the Cost Sharing Scheme for Electric Bikes and Rickshaws/Loaders 2025.

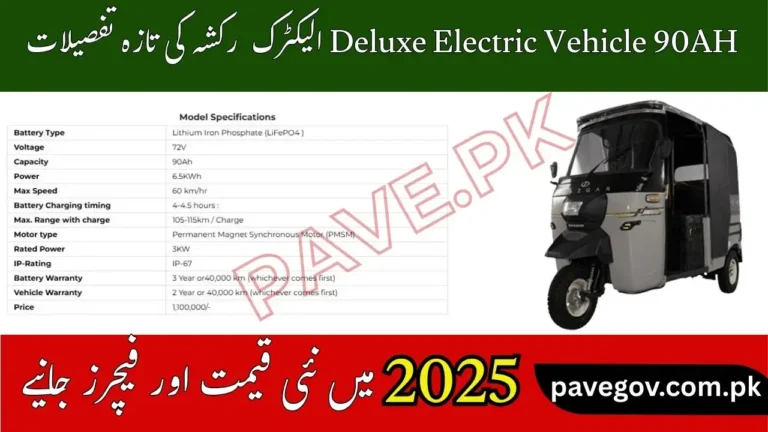

The program will finance 116,000 e-bikes and 3,170 e-rickshaws/loaders in FY 2025-26. With 0% markup loans, capital subsidies of up to PKR 200,000, and easy installments, this scheme is highly attractive. But approval depends on credit score, income verification, and eligibility checks performed by banks.

Credit Score SBP Electric Vehicle Loan 2025 Pakistan – Complete Overview

The Credit Score SBP Electric Vehicle Loan 2025 Pakistan initiative has been introduced by the State Bank of Pakistan (SBP) to promote clean energy and affordable financing for electric vehicles. Under this scheme, individuals with a minimum credit score requirement can now apply for loans to purchase electric bikes, cars, and rickshaws on easy installments.

The Electric Bike Scheme 2025 and PM Electric Bike Scheme 2025 both operate in coordination with SBP’s green financing model, enabling students, employees, and small business owners to switch to eco-friendly vehicles. The program aims to support Pakistan’s transition toward sustainable mobility while reducing dependence on costly fuel imports.

Credit Score SBP Electric Vehicle Loan 2025 PDF & Online Application

Applicants can download the official Credit Score SBP Electric Vehicle Loan 2025 PDF from the SBP Circulars 2025 section available on the central bank’s website. This document outlines the eligibility criteria, required credit score, and detailed loan structure for electric vehicle financing.

To start the process, users can visit the Credit Score SBP Electric Vehicle Loan 2025 Apply Online portal through partner banks such as HBL, Meezan Bank, and Bank Alfalah. The government’s collaboration with SBP ensures low markup rates, longer repayment periods, and priority access for applicants with verified income sources and clean credit histories.

E-Bike Scheme Registration & Status Check 2025

Beneficiaries of the E Bike Scheme Pakistan Apply Online program can also avail themselves of the SBP’s electric vehicle loan to make their e-bike purchase easier. Once registered, users can verify their application progress through the E Bike Scheme Check Status page available on official portals.

The SBP Electric Vehicle Loan 2025 initiative ensures that individuals with good financial credibility can secure financing without heavy documentation. By linking credit score verification to the e-bike financing process, the government and SBP are jointly promoting transparency, green technology adoption, and financial inclusion across Pakistan’s growing electric vehicle sector.

Why Credit Score Matters in SBP Electric Vehicle Loan 2025:

What is a Credit Score?

A credit score is a numerical representation of a borrower’s creditworthiness. It reflects their ability to repay loans based on past borrowing, repayment history, and financial behavior.

Credit Score & SBP EV Loan Approval

- Banks will evaluate applicants using their own risk appetite and credit policy.

- Applicants with a strong repayment history are more likely to get fast approval.

- Those with poor credit history may face stricter checks or rejection.

Benefits of a Good Credit Score in this Scheme

- Higher chances of loan approval

- Faster processing time

- Access to full financing limits (PKR 200,000 for bikes, PKR 880,000 for rickshaws/loaders)

- Stronger trust from banks for future loans

Read Also: PAVE Balloting Status Track Nadra Bank Verification

Income Verification in SBP EV Scheme 2025:

Why Income Verification is Important

Banks must ensure that borrowers have the financial capacity to repay. Even though the government provides subsidies and full markup coverage, borrowers still need to pay:

- Principal amount in EMIs

- Insurance premiums

- Registration charges

Methods of Income Verification

- Salary Slips – For salaried individuals

- Bank Statements – To verify regular income or business deposits

- Proxy Methods – For self-employed individuals without formal income records (e.g., small shopkeepers, delivery riders)

This flexibility allows both formal and informal sector workers to benefit from the scheme.

Eligibility Criteria for Borrowers 2025:

Age Limit

- E-bikes: 18–65 years

- Rickshaws/Loaders: 21–65 years

Citizenship

- Must be a Pakistani citizen, including residents of Gilgit-Baltistan (GB) and Azad Jammu & Kashmir (AJK).

Categories Eligible

- Individual Citizens (students, employees, entrepreneurs)

- Fleet Operators (up to 30% of loader quota)

- Women (25% of e-bikes reserved for female applicants)

- Delivery Riders (10% quota for business-use e-bikes)

Debt Burden Ratio & Affordability 2025:

Banks will also calculate Debt Burden Ratio (DBR) as per SBP Prudential Regulations.

- DBR ensures borrowers are not overburdened with loans.

- If your current loan installments are too high compared to your income, your application may be declined.

Read Also: CM Punjab Aghosh Program vs Other Punjab Welfare Schemes 2025

Loan Highlights under SBP EV Scheme 2025:

| Feature | Details |

|---|---|

| Loan Size | PKR 200,000 (e-bike), PKR 880,000 (rickshaw/loader) |

| Capital Subsidy | PKR 50,000 (bike), PKR 200,000 (rickshaw/loader) |

| Debt-to-Equity Ratio | 80:20 (with subsidy covering equity in many cases) |

| Loan Tenor | 2 years (e-bike), 3 years (rickshaw/loader) |

| End User Rate | 0% markup (government bears interest) |

| Processing Charges | Nil |

| Early Settlement Charges | Nil |

Role of Banks in Credit Score & Income Checks:

- Banks use a credit scorecard system to assess risk.

- NADRA Verisys and PMD checks will confirm identity and phone number records.

- Income estimation methods allow flexibility for low-income or informal workers.

- Banks have full authority to approve or decline applications based on their credit policies.

Challenges for Borrowers:

- Low or No Credit History – New borrowers may need proxy income checks.

- Unstable Income – Daily wage earners may find it difficult to prove repayment ability.

- Multiple Loans – Borrowers with existing loans may struggle with DBR requirements.

- Informal Sector Workers – Without formal documents, verification takes longer.

Read More: PAVE Application Completed After Balloting Selection – What Happens

Tips to Improve Your Chances of Loan Approval:

- Maintain a healthy bank account history.

- Pay existing loan installments on time.

- Keep your CNIC and documents updated.

- If self-employed, show proof of business income.

- Avoid taking multiple loans before applying.

FAQs Credit Score SBP Electric Vehicle Loan 2025:

Q1: Is credit score mandatory for SBP EV Scheme 2025?

Yes, banks will evaluate applicants using their own credit scorecards and policies.

Q2: Can I apply if I don’t have a credit history?

Yes, banks may use proxy income methods, but approval depends on risk assessment.

Q3: How is income verified for daily wage earners or freelancers?

Through bank statements, business receipts, or proxy methods as allowed by SBP guidelines.

Q4: What happens if my debt burden ratio is high?

Banks may reject your application if your DBR exceeds SBP’s prudential limits.

Q5: Do women applicants also need credit score checks?

Yes, all applicants, including women and fleet operators, undergo the same checks.

Q6: How does subsidy affect credit score checks?

Subsidy reduces upfront cost but banks still ensure repayment capacity before approval.

Q7: Can fleet operators apply with company accounts?

Yes, but eligibility criteria will be determined by the Steering Committee.

Q8: Will poor credit history automatically disqualify me?

Not always, but banks may impose stricter conditions or lower financing limits.

Q9: How do banks calculate EMI?

EMI includes principal + insurance premium, with no markup charges.

Q10: Are loan processing charges applicable?

No, the scheme has zero loan processing charges.

Conclusion – Credit Score SBP Electric Vehicle Loan 2025

The Credit Score SBP Electric Vehicle Loan 2025 ensures that financing for electric bikes and rickshaws/loaders is not just about subsidies, but also about responsible lending and repayment capacity. Banks play a key role by checking credit scores, income records, and debt burden ratios to ensure borrowers can repay without defaulting.